The total market risk a business faces is linked to its value chain and a consequence of the chosen strategy. Market risk is managed mainly through the strategic choices the business makes. Only through strategic risk taking will value be created. Therefore it is not desirable to remove all risk.

What risks should be mitigated depends on whether hedging will reduce potential value creation – the desired result of strategic choices – and whether there is a functioning market for hedging.

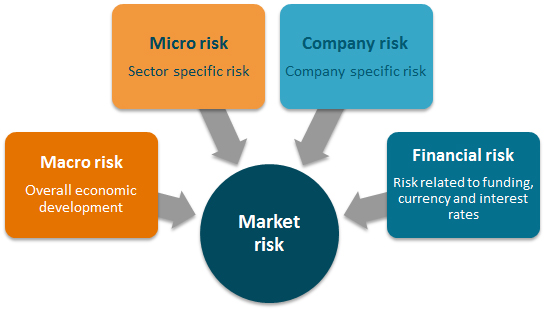

Market risk consists of four main components:

- Macro risk – overall economic development, trends, demography and so on

- Micro risk – sector specific development, trends, demography and so on

- Company specific risk – unique to the individual business; profitability, ownership structure, quality of assets and so on

- Financial risk – funding, cash flow, liquidity, currency, interest rates and so on

The macroeconomic risk is only to a limited degree controllable for the individual business. This kind of risk impacts the economy as a whole to a greater or lesser extent as economic growth, global trends, trade conditions, demography or other economy wide developments. The financial crisis and its impact on growth, funding and market balance is a result of macro risk.

The microeconomic risk only impacts sectors of the economy and may be different from the overall economic development. Some sectors are growing while others are decimated over a short period of time, independent of the overall development. Each business has made a strategic choice to be in the sector it is in. Its owners have chosen that specific sector because they see a potential for value creation. This risk is mainly controlled by making strategic choices.

The company specific risk is unique to each business and a result of macro- and microeconomic development and the chosen strategy each business has made. Important company specific factors are the quality of assets, ownership structure, profitability, balance sheet mix and other factors which make the business different than its competitors in the same sector of the economy. This risk is mainly controlled by the company’s internal control and governance.

The financial risk includes financing and liquidity (refinancing risk), currency and interest rate risk and some commodity risks. This risk is in essence components of the three other risk groups, but there are good reasons to separate it as a group. The main reason is that this kind of risk often is a result of chosen strategy without being the main reason for choosing the strategy. It may also a consequence of previous strategic choices which may limit the ability to grab new opportunities. An example of this is the balance sheet size and mix between debt and equity being a result of previous investments.

A more pragmatic reason is that financial risks are often (of the few) risks where there is a functioning and liquid hedging market. Hence, financial risks may be hedged to reduce overall risk.