-

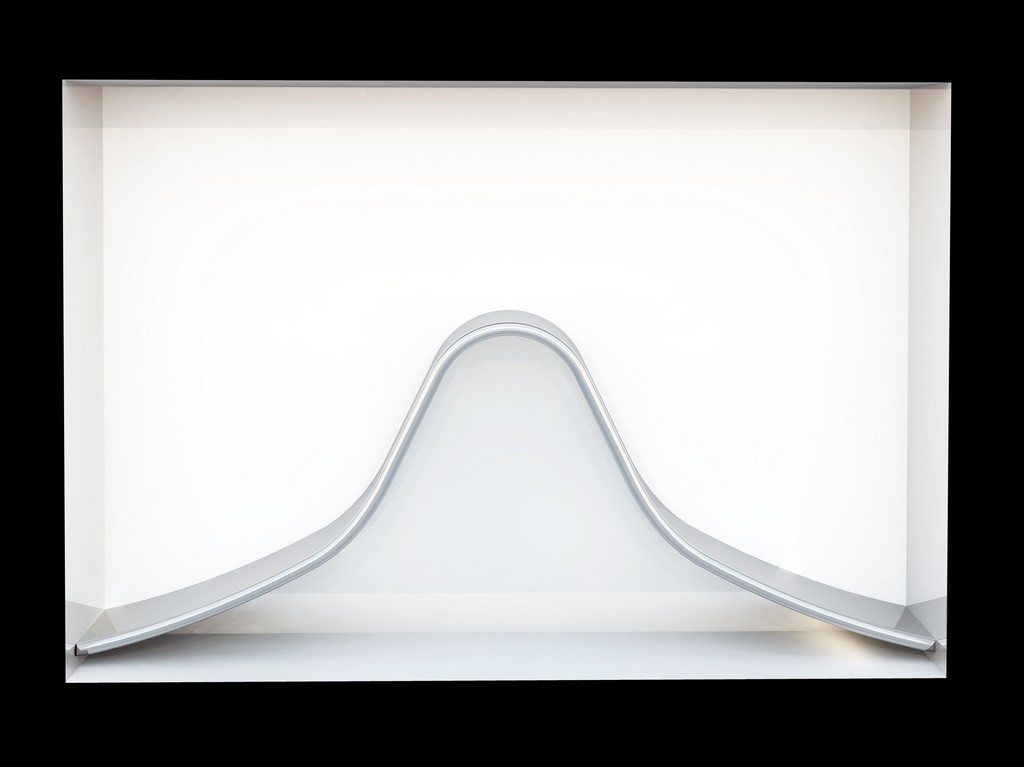

Modelling volatility

An estimate of variability is the most important input into a risk model. Risk arises because the actual variable values differ from the expected value. This is why the first question you need to ask yourself in order to estimate risk is: How much can the variables be expected to differ from the expected value?…

-

Modelling correlations

In a model which aims to estimate risk there are two main indicators which are used to describe the uncertainty in the variables: Volatility: How much can variable values be expected to differ from their expected values? Correlation: How do different variables impact each other? In this article I will cover modelling of correlation. If…

-

Risk modelling with Excel @Risk

Excel @Risk is an Add-in to Excel made by Palisade Corporation. With an Excel-model as basis, @Risk can simulate and calculate figures which will assess the risk in the base calculations. So, the starting point for risk modelling with Excel is a model which captures the relationships between variables you want to model. In most…

-

Risk modeling the budget

Using risk modeling in the budget process will contribute to turning the budget into more of a strategic tool for management, as it will provide significantly more information and decision support than what a traditional static budget will do. In traditional budgeting, the focus is on putting static assumptions on variables for the year or…